Bank of Canada holds interest rate steady

Pete Evans · CBC News • March 9, 2023

First time Canada's central bank has decided not to hike in a year.

It's the first time in more than a year that the central bank has decided not to raise its interest rate.

Although it will come as encouraging news to borrowers, the move was widely expected, as the bank signalled at its previous policy meeting and in statements since then that it was leaning toward keeping its rate steady.

The bank feels confident in standing pat because there is growing evidence that sky-high inflation is starting to ease.

The bank noted recent data suggesting Canada's economy didn't expand at all in the last three months of 2022, and household spending and business investment are both starting to slow in response to the bank's previous rate hikes.

That's a sign that the bank's campaign to wrestle inflation into submission is working, but the bank made it clear in its statement that it is prepared to raise rates even higher then they are, should circumstances change.

'"[The bank] will continue to assess economic developments and the impact of past interest rate increases, and is prepared to increase the policy rate further if needed to return to the two per cent inflation target," the Bank of Canada said.

The best-case scenario for the bank is that it is able to stand on the sidelines while inflation slowly eases from here. But it may be forced to change that plan because of things beyond its control.

A major factor is what's happening in the United States, where the central bank is making it clear that it has no intention of holding the line on interest rates.

"If ... the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes," Federal Reserve chair Jay Powell told a congressional committee in Washington, D.C., on Wednesday, ahead of the U.S central bank's rate decision scheduled for next week.

A major factor is what's happening in the United States, where the central bank is making it clear that it has no intention of holding the line on interest rates.

"If ... the data were to indicate that faster tightening is warranted, we would be prepared to increase the pace of rate hikes," Federal Reserve chair Jay Powell told a congressional committee in Washington, D.C., on Wednesday, ahead of the U.S central bank's rate decision scheduled for next week.

Currently, the U.S. central bank rate is slightly higher than Canada's, at 4.75 per cent. But while the messaging out of Canada has been hinting that rates will hold steady for a while, the tone out of the U.S. has been that more hikes are coming.

Investors are expecting as many as two more rate hikes by June, moves that would bring the U.S. rate to 5.5 per cent — a full percentage point higher than Canada's. If a gap that wide comes to pass, it would strongly push down the value of Canada's dollar, which would make the Bank of Canada's inflation fight much harder.

"We would be importing inflation," Philip Petursson, chief investment strategist with IG Wealth Management, said in an interview with CBC News.

That's because so much of what Canadians consume — especially food — is imported from the United States, so a weaker Canadian dollar would make all those imports more expensive, and make inflation even worse.

Investors are expecting as many as two more rate hikes by June, moves that would bring the U.S. rate to 5.5 per cent — a full percentage point higher than Canada's. If a gap that wide comes to pass, it would strongly push down the value of Canada's dollar, which would make the Bank of Canada's inflation fight much harder.

"We would be importing inflation," Philip Petursson, chief investment strategist with IG Wealth Management, said in an interview with CBC News.

That's because so much of what Canadians consume — especially food — is imported from the United States, so a weaker Canadian dollar would make all those imports more expensive, and make inflation even worse.

If the U.S. keeps hiking while Canada stands pat, "the Bank of Canada would raise rates to defend the dollar but that hurts the economy in other ways," Petursson said.

"They'd be stuck between a rock and a hard place."

Derek Holt, an economist with Scotiabank, thinks a sharply weaker loonie could indeed derail the central bank's best laid plans.

"I think they're ignoring currency weakness and the potential for that currency weakness to become an even greater issue as the Fed marches higher and higher, leaving the Bank of Canada behind," he said. "I think they've set themselves up awkwardly to potential developments going forward."

"They'd be stuck between a rock and a hard place."

Derek Holt, an economist with Scotiabank, thinks a sharply weaker loonie could indeed derail the central bank's best laid plans.

"I think they're ignoring currency weakness and the potential for that currency weakness to become an even greater issue as the Fed marches higher and higher, leaving the Bank of Canada behind," he said. "I think they've set themselves up awkwardly to potential developments going forward."

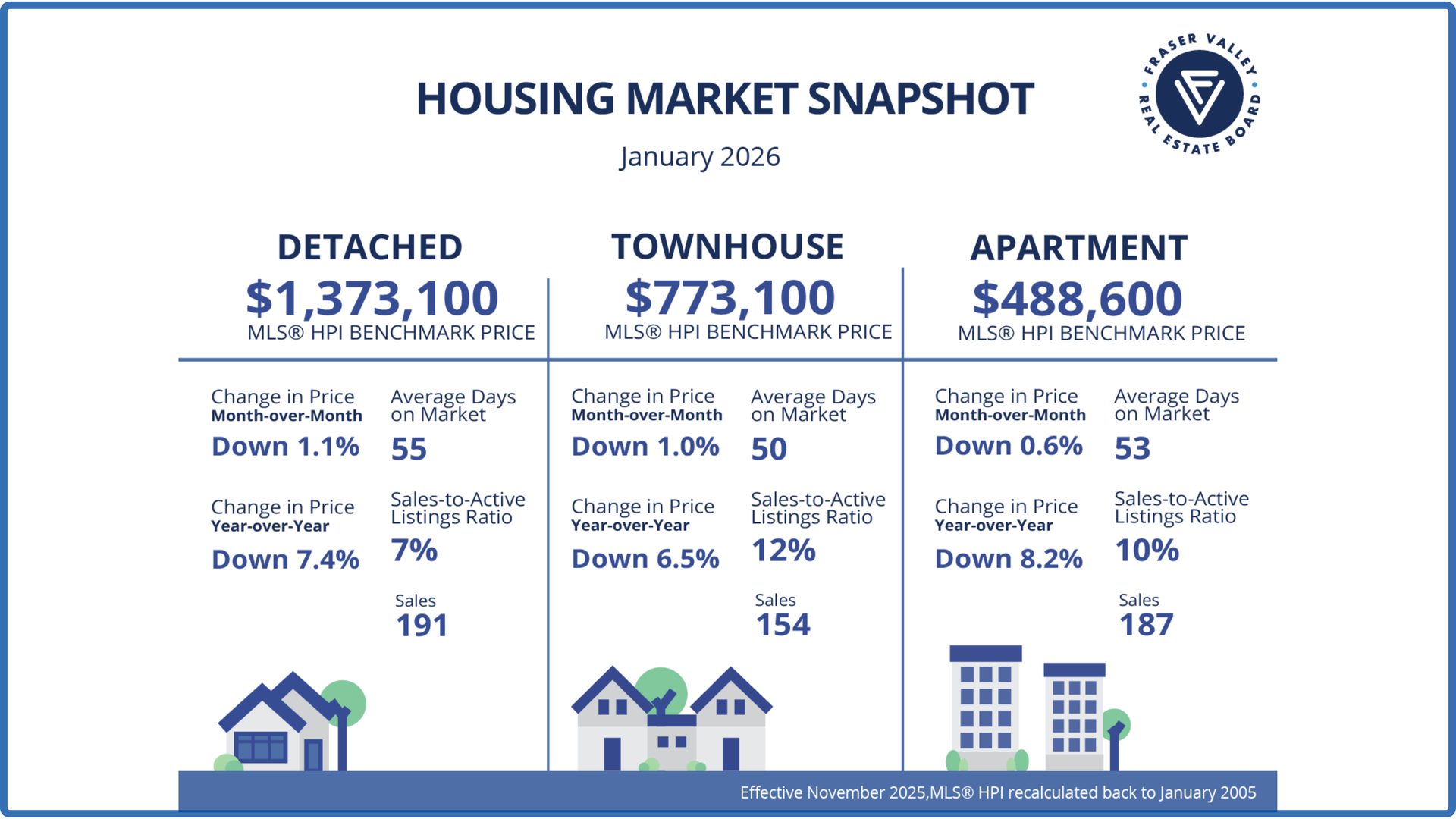

🏡 Fraser Valley home prices back to pandemic-era levels under the weight of economic headwinds and sustained inventory 📉 SURREY, BC – Home prices in the Fraser Valley fell for the tenth consecutive month in January, pushing the Benchmark price below $900,000 for the first time since spring 2021. The Benchmark price for a typical home in the Fraser Valley dropped one per cent in January to $897,200, down 6.9 per cent year-over-year. The continued softening of prices wasn’t enough to get buyers off the sidelines, as the Fraser Valley Real Estate Board recorded 619 sales on its Multiple Listing Service® (MLS®) in January, a 33 per cent decrease from December, and 24 per cent below sales from the same month last year. New listings increased 128 per cent in January to 3,078, reflecting the typical seasonal patterns; however, activity remained 10 per cent below last year’s levels.