Buying opportunities remain untapped in Fraser Valley

SURREY, BC — Economic uncertainty continued to be the main driver in buying decisions as home sales in the Fraser Valley remain mostly unchanged, despite abundant inventory and lower prices.

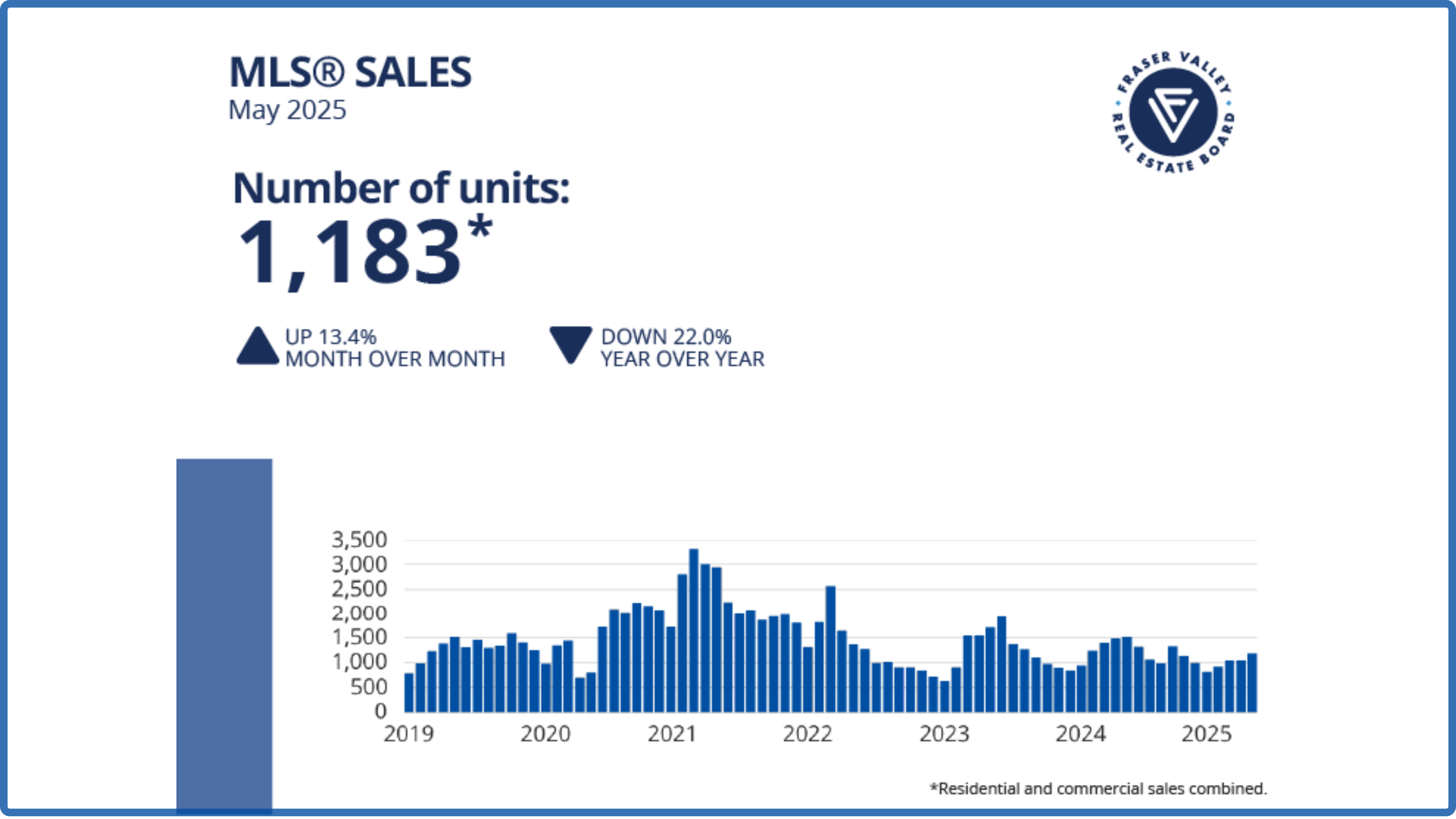

The Fraser Valley Real Estate Board recorded 1,195 sales on its Multiple Listing Service® (MLS®) in June, up one per cent from May, but nine per cent below sales from June 2024 and 33 per cent below the 10-year average.

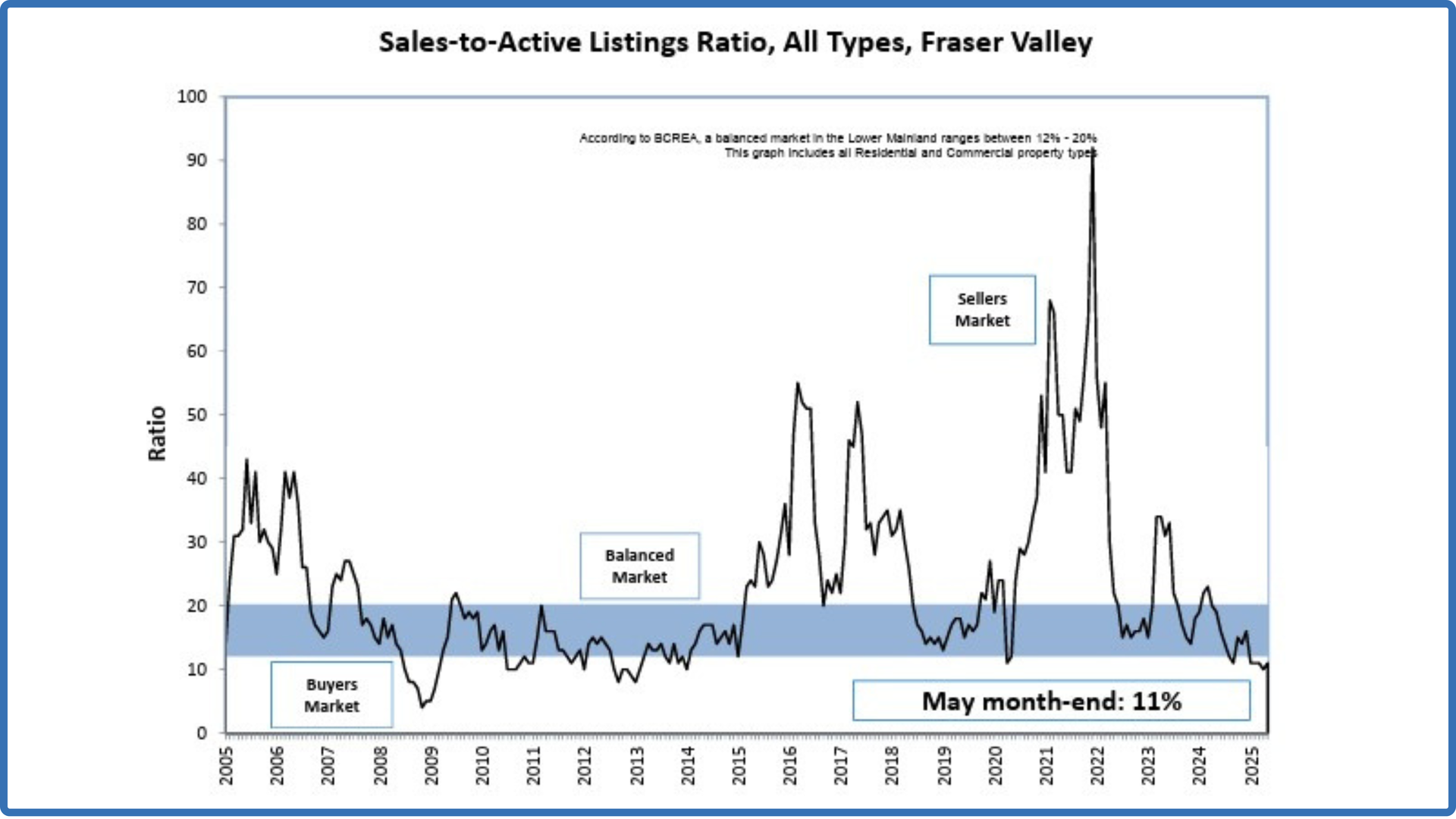

The Fraser Valley remains in a buyer’s market with the supply of available homes continuing to build. Active listings approached 11,000 in June — a two per cent increase over May and 30 per cent above levels from this time last year. New listings declined 10 per cent over May to 3,618. The overall sales-to-active listings ratio is steady at 11 per cent; the market is considered balanced when the ratio is between 12 per cent and 20 per cent.

“For buyers who can tolerate the current economic uncertainty, this market offers some very real opportunities,” said Tore Jacobsen, Chair of the Fraser Valley Real Estate Board. “With more homes to choose from and softening prices, it’s a uniquely favourable time to make a move in the Fraser Valley, particularly for first-time buyers.

Across the Fraser Valley in June, the average number of days to sell a condo was 39 days, while for a single-family detached home it was 35 days. Townhomes took, on average, 30 days to sell.

“There’s no question the economy continues to grapple with unpredictability surrounding trade and tariffs, and the real estate market, like all sectors, is adapting to an uncertain future,” said Baldev Gill, CEO of the Fraser Valley Real Estate Board. “Perhaps this presents an opportunity for government to revisit policy decisions of the past, which may have served their purposes under different market conditions, in support of new economic realities.”

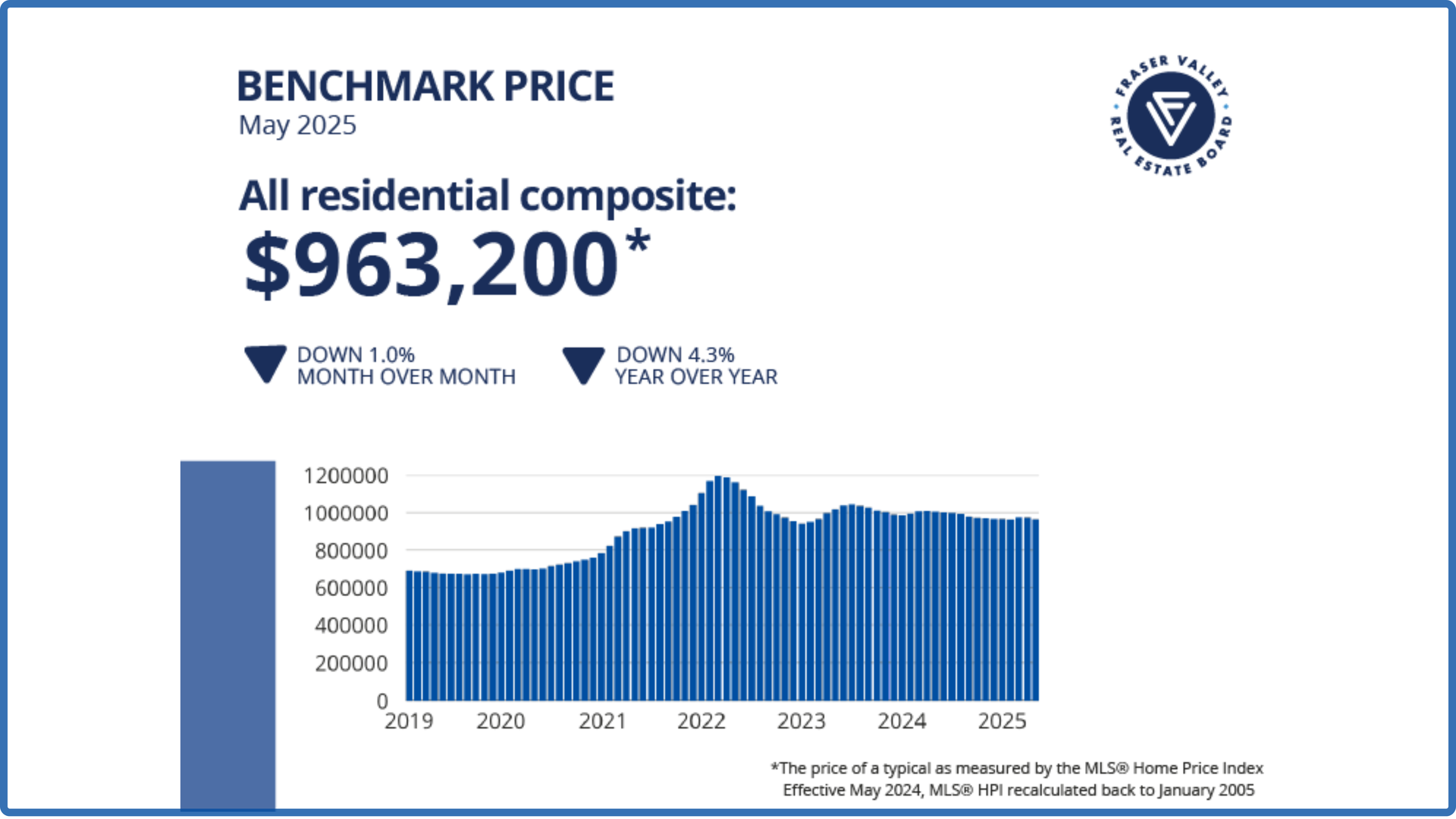

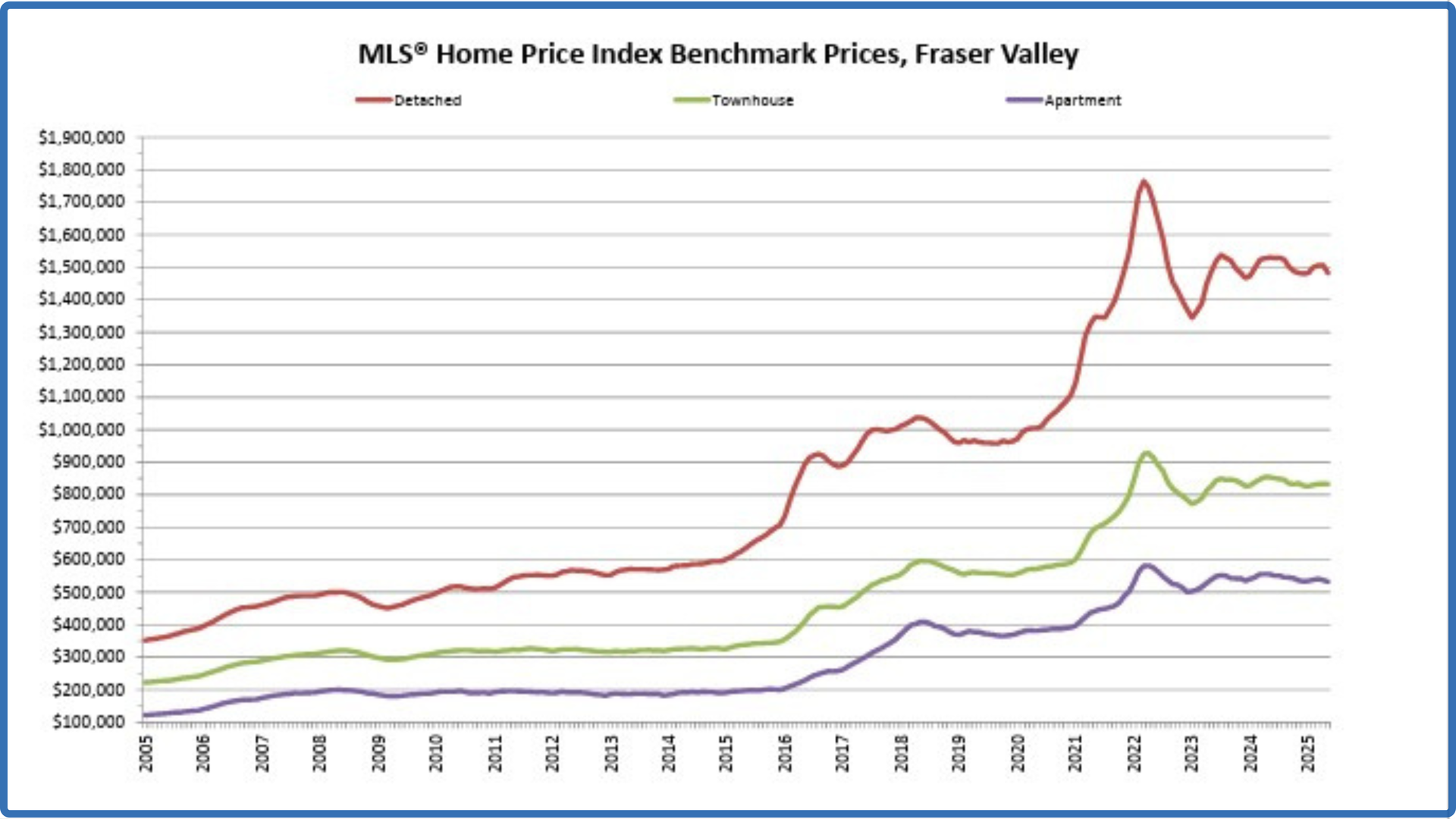

The composite Benchmark price in the Fraser Valley decreased 1.2 per cent in June, to $951,500.

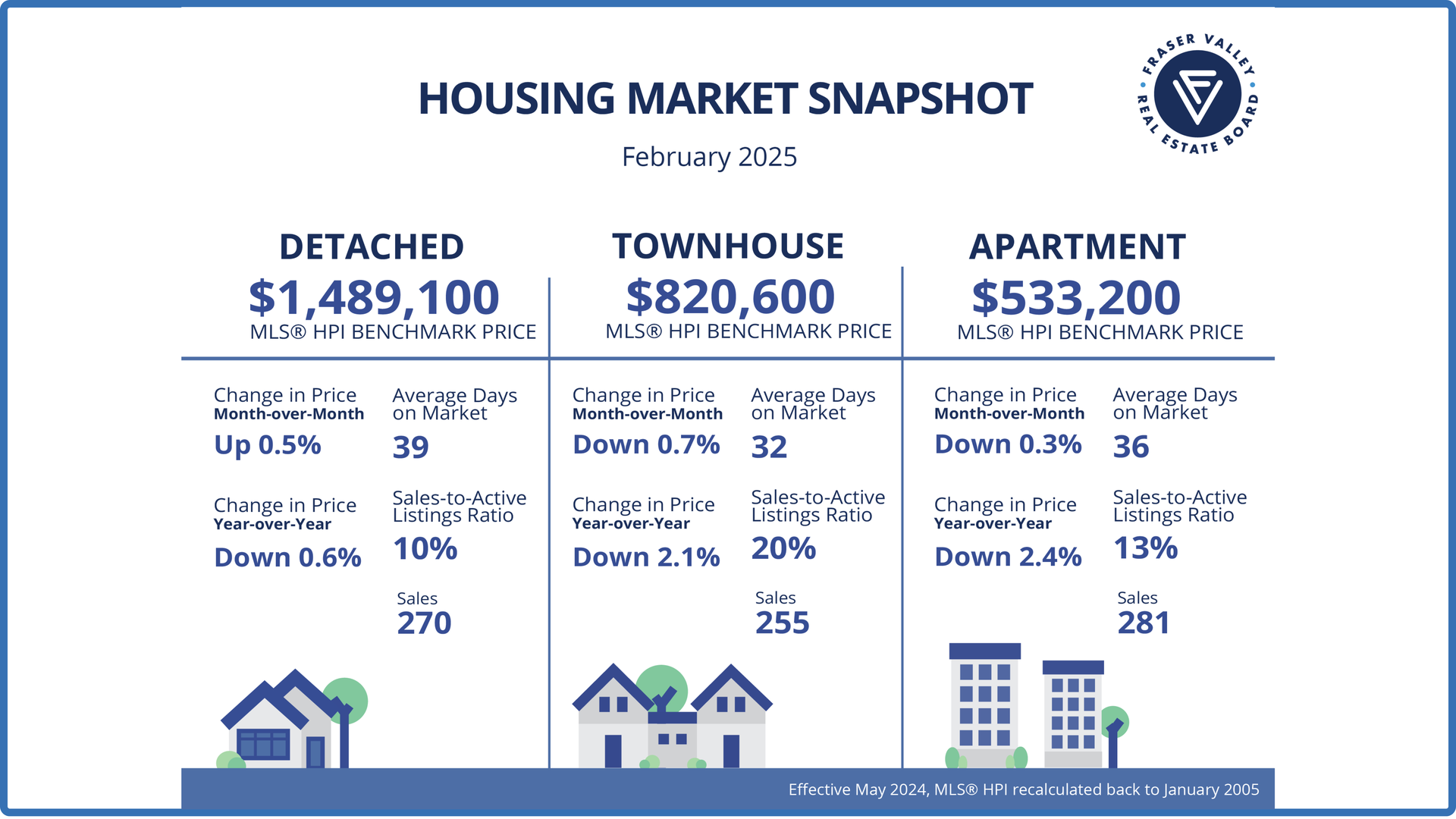

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,458,600, the Benchmark price for an FVREB single-family detached home decreased 1.6 per cent compared to May 2025 and decreased 4.6 per cent compared to June 2024.

- Townhomes: At $824,400 the Benchmark price for an FVREB townhome decreased 1.0 per cent compared to May 2025 and decreased 3.1 per cent compared to June 2024.

- Apartments: At $526,500 the Benchmark price for an FVREB apartment/condo decreased 1.2 per cent compared to May 2025 and decreased 4.5 per cent compared to June 2024.