Fraser Valley Home Sales 🏡📉 Fall Despite Rate Cut 📉💲

SURREY, BC — The policy rate cut of 25 basis points by the Bank of Canada on June 5 was not enough to rally home sales in the Fraser Valley last month.

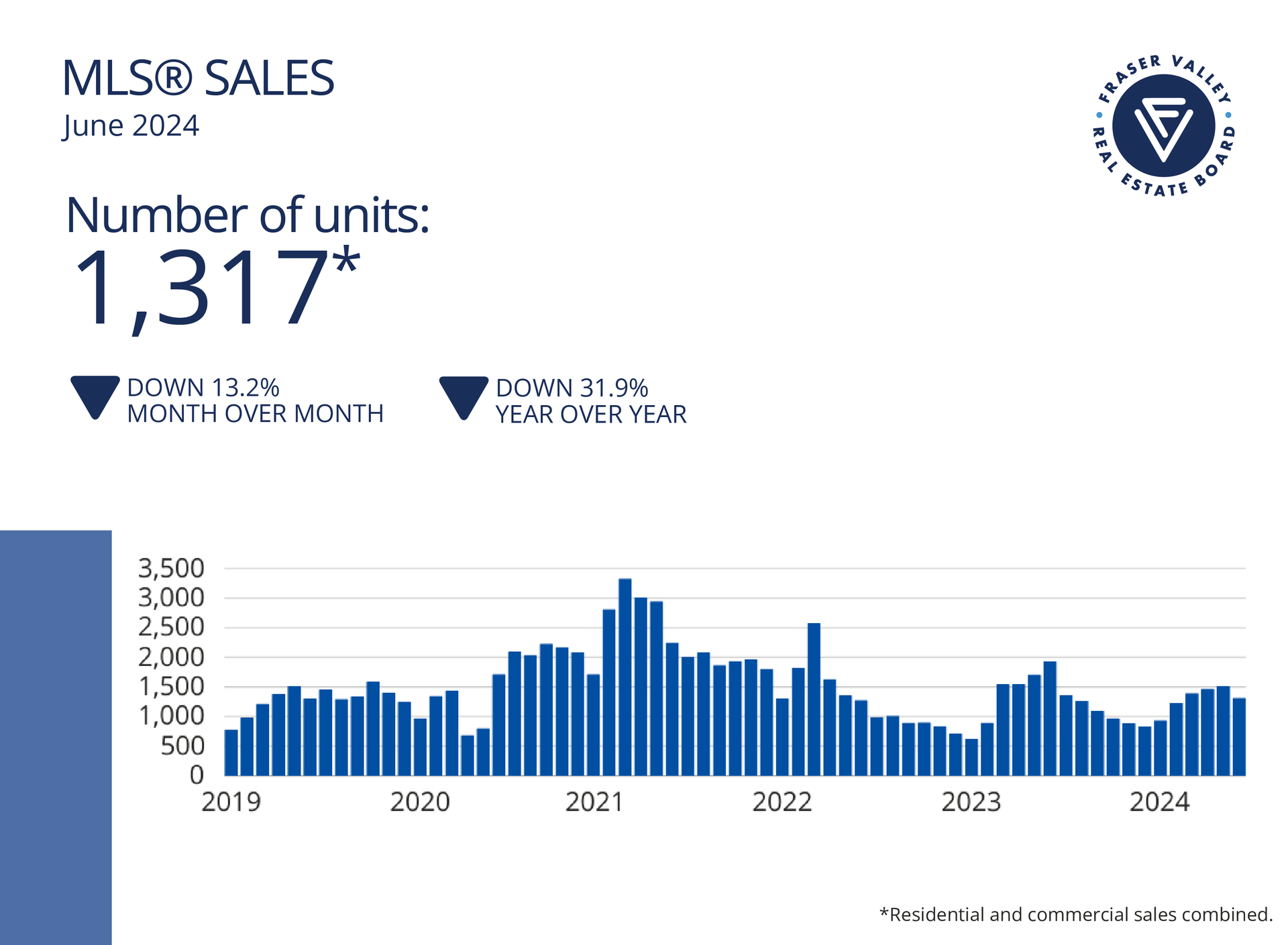

The Fraser Valley Real Estate Board recorded 1,317 sales in June, down by 13 per cent over last month and by more than 30 per cent over both last year and the 10-year seasonal average.

While sales remain soft, inventory continued to build for the sixth straight month to 8,350 active listings. Active listings increased 41 per cent over June 2023 and are the highest they’ve been in five years.

“With seasonally slow sales in June and a steady increase in inventory, we’d expect to see affordability improve,” said Jeff Chadha, Chair of the Fraser Valley Real Estate Board. “However, prices in the Fraser Valley remained relatively flat. That said, despite slow sales, properties that are well-priced are finding buyers, and are subsequently selling within three to four weeks.”

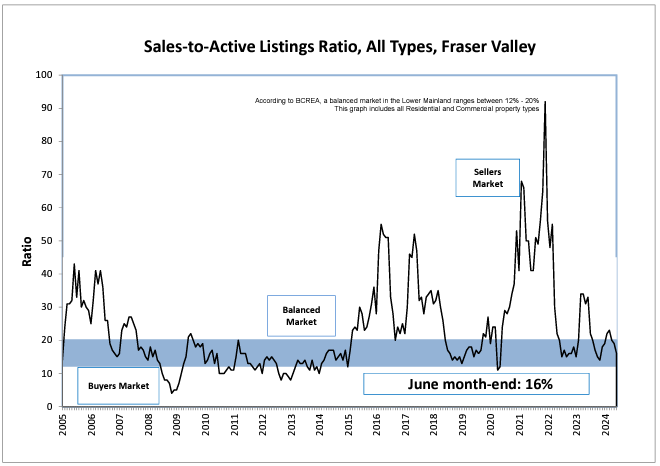

New listings dropped in June, down nine per cent from May, to 3,418. With a sales-to-active listings ratio of 16 per cent, overall market conditions are balanced. The market is considered balanced when the ratio is between 12 per cent and 20 per cent.

“The June rate cut hasn’t been enough to get buyers off the sidelines,” said FVREB CEO, Baldev Gill. “Current market conditions are such that buyers and sellers are advised to have thoughtful conversations with their REALTOR® and lending professional, rather than relying on media reports about where interest rates may be heading in the future.”

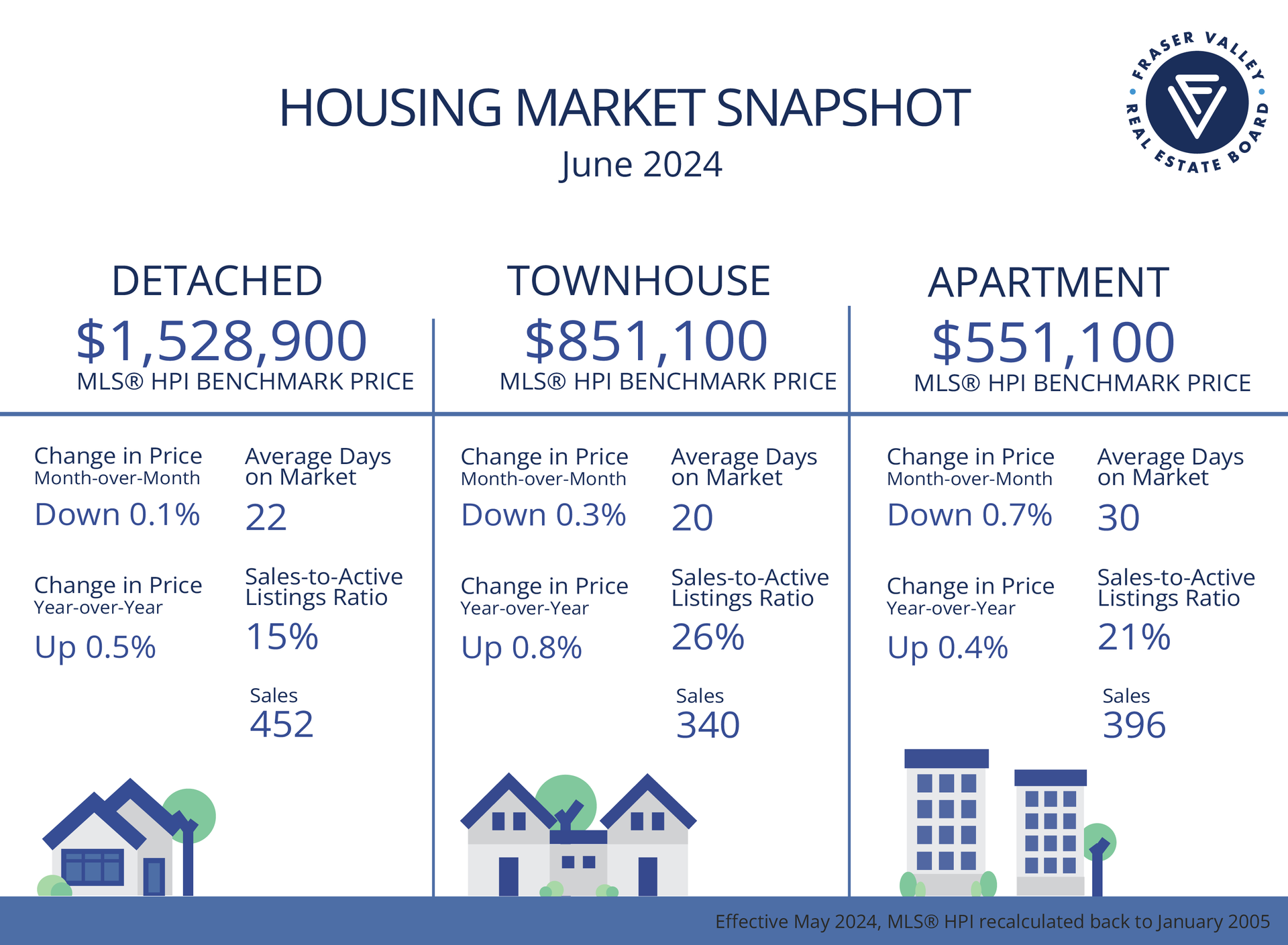

Across the Fraser Valley in June, the average number of days to sell a single-family detached home was 22, while a townhome was 20. Condos took on average, 30 days to sell.

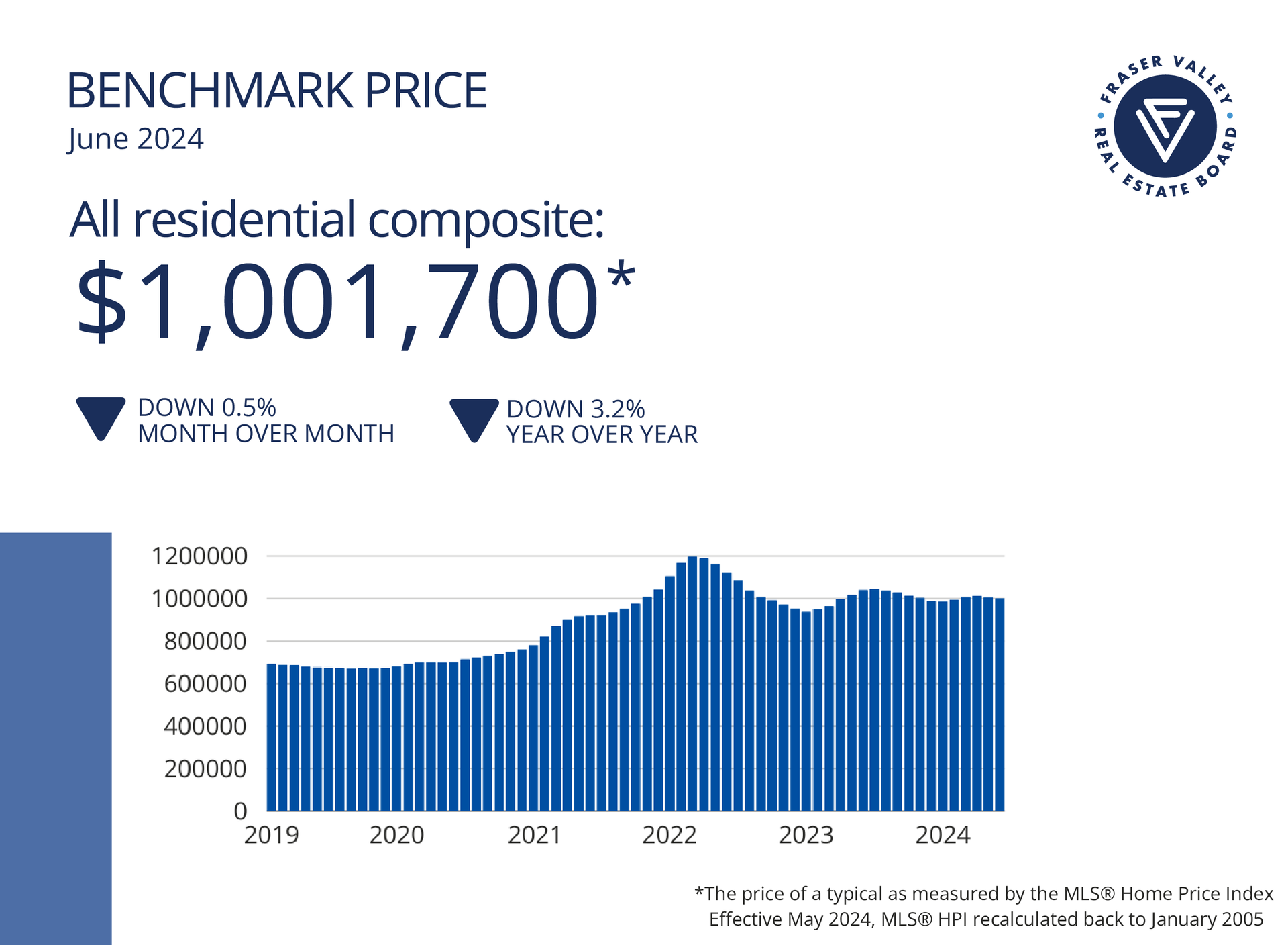

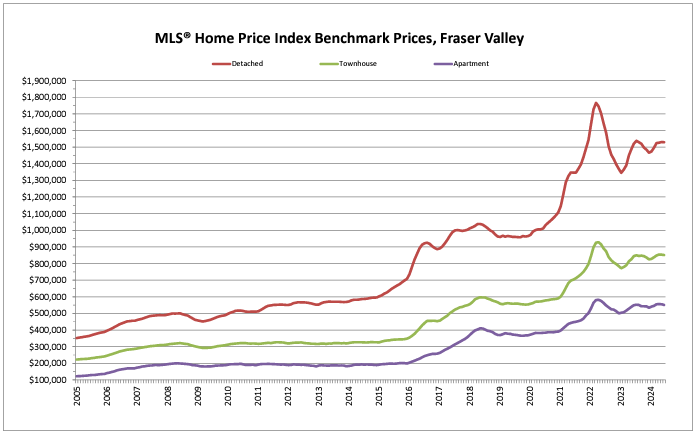

Benchmark prices in the Fraser Valley remained relatively flat in June, with the composite Benchmark price down 0.5 percent from May and down 3.2 per cent from June 2023.

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,528,900, the Benchmark price for an FVREB single-family detached home decreased 0.1 per cent compared to May 2024 and increased 0.5 per cent compared to June 2023.

- Townhomes: At $851,100, the Benchmark price for an FVREB townhome decreased 0.3 per cent compared to May 2024 and increased 0.8 per cent compared to June 2023.

- Apartments: At $551,100, the Benchmark price for an FVREB apartment/condo decreased 0.7 per cent compared to May 2024 and increased 0.4 per cent compared to June 2023.