Mortgage Fraud Protection

BC Real Estate Lawyers • February 16, 2023

Throughout the past few years, a huge spike has occurred in real estate fraud throughout Canada and BC, but we can help prevent it.

Real estate fraud is becoming more and more common. Where it was once unheard of for someone to pose as an owner and sell a property belonging to someone else, this is no longer a rare incident. Throughout the past few years, a huge spike has occurred in real estate fraud throughout Canada and BC, but we can help prevent it.

There are 2 main types of fraud – mortgage fraud and title fraud.

The typical mortgage fraud scenario occurs when a fraudster uses false identification to impersonate the true owner of the property. Using this false identification, the fraudster approaches a lender, has a mortgage approved and signs all the necessary documents. Neither the lender nor the lawyer/notary is aware that the identification is false, resulting in a charge on title. By the time the true owner learns of the mortgage, the fraudster has vanished. Unfortunately, the true owner of the property must bear the expense of cancelling the mortgage.

A rarer, yet more serious, fraud is title fraud. Again, using false identification, the fraudster approaches a realtor to list the property. The contract of purchase and sale is entered, and again all necessary documents are signed using the false identification. Neither the realtor nor lawyer/notary is aware that the identification is false, resulting in a transfer of title from the true owner to an innocent third-party purchaser. By the time the true owner learns of the transfer, the fraudster has vanished.

The effects of title fraud are much more serious, and often devastating. Why? Because in British Columbia a person may lose their home if the fraudster sells to an innocent third party. Yes, someone could forge the identity of an unsuspecting homeowner, sell that property to a bona fide purchaser who has no knowledge of the fraud, and the current homeowner loses their home. The true owner can apply for compensation from the Assurance Fund which is administered by the Land Title and Survey Authority; however, the bona fide purchaser will retain title to the home.

Fraudsters prefer to work with properties that are ‘free and clear’ of all financial charges, so an owner could place a line of credit type mortgage on title. This will reduce, but not eliminate the risk of title fraud. Alternatively, the true owner could obtain a title insurance policy to cover the costs of clearing title or compensate for the loss of title. Again, this does not eliminate or even reduce the risk of title fraud, title insurance only offers an easier path of compensation. Title insurance, however, will not prevent mortgage or title fraud.

The only way to prevent real estate fraud from ever occurring for mortgage-free homes is to pull and secure the Duplicate Indefeasible Title Certificate (DIT) from the Land Title Survey Authority (LTSA). By pulling the DIT from the LTSA, the title to the home is effectively frozen, ensuring no party (even the homeowner) can place a charge on the title, or transfer title to a third party.

Proper storage of the DIT is critical. If the document is ever lost a new certificate must be issued from the LTSA, a process that can take months and several thousand dollars. Any owner pulling the DIT should take great care to not lose that document.

If your home is free and clear of any mortgages, and this fraud prevention is of importance to you, you have options:

Real estate fraud is becoming more and more common. Where it was once unheard of for someone to pose as an owner and sell a property belonging to someone else, this is no longer a rare incident. Throughout the past few years, a huge spike has occurred in real estate fraud throughout Canada and BC, but we can help prevent it.

There are 2 main types of fraud – mortgage fraud and title fraud.

The typical mortgage fraud scenario occurs when a fraudster uses false identification to impersonate the true owner of the property. Using this false identification, the fraudster approaches a lender, has a mortgage approved and signs all the necessary documents. Neither the lender nor the lawyer/notary is aware that the identification is false, resulting in a charge on title. By the time the true owner learns of the mortgage, the fraudster has vanished. Unfortunately, the true owner of the property must bear the expense of cancelling the mortgage.

A rarer, yet more serious, fraud is title fraud. Again, using false identification, the fraudster approaches a realtor to list the property. The contract of purchase and sale is entered, and again all necessary documents are signed using the false identification. Neither the realtor nor lawyer/notary is aware that the identification is false, resulting in a transfer of title from the true owner to an innocent third-party purchaser. By the time the true owner learns of the transfer, the fraudster has vanished.

The effects of title fraud are much more serious, and often devastating. Why? Because in British Columbia a person may lose their home if the fraudster sells to an innocent third party. Yes, someone could forge the identity of an unsuspecting homeowner, sell that property to a bona fide purchaser who has no knowledge of the fraud, and the current homeowner loses their home. The true owner can apply for compensation from the Assurance Fund which is administered by the Land Title and Survey Authority; however, the bona fide purchaser will retain title to the home.

Fraudsters prefer to work with properties that are ‘free and clear’ of all financial charges, so an owner could place a line of credit type mortgage on title. This will reduce, but not eliminate the risk of title fraud. Alternatively, the true owner could obtain a title insurance policy to cover the costs of clearing title or compensate for the loss of title. Again, this does not eliminate or even reduce the risk of title fraud, title insurance only offers an easier path of compensation. Title insurance, however, will not prevent mortgage or title fraud.

The only way to prevent real estate fraud from ever occurring for mortgage-free homes is to pull and secure the Duplicate Indefeasible Title Certificate (DIT) from the Land Title Survey Authority (LTSA). By pulling the DIT from the LTSA, the title to the home is effectively frozen, ensuring no party (even the homeowner) can place a charge on the title, or transfer title to a third party.

Proper storage of the DIT is critical. If the document is ever lost a new certificate must be issued from the LTSA, a process that can take months and several thousand dollars. Any owner pulling the DIT should take great care to not lose that document.

If your home is free and clear of any mortgages, and this fraud prevention is of importance to you, you have options:

- You can pull the DIT yourself – please visit https://ltsa.ca/wp-content/uploads/2020/11/Duplicate-Indefeasible-Title-Certificate.pdf;

- You can retain us to pull the DIT and forward to you for safekeeping. Our fee for this service is $350.00 plus taxes and LTSA fees. Again, be careful with this document. If lost it will cost you several thousand dollars and many months to replace;

- You can retain us to pull the DIT and store it in our fireproof safe in a secured and fire protected location. Our fee for this will be $450.00 plus taxes and LTSA fees. This includes storage of the DIT for one year;

- Our annual fees for safekeeping of the DIT will be $120.00, billed annually starting on the day one year the DIT is placed in our secured location;

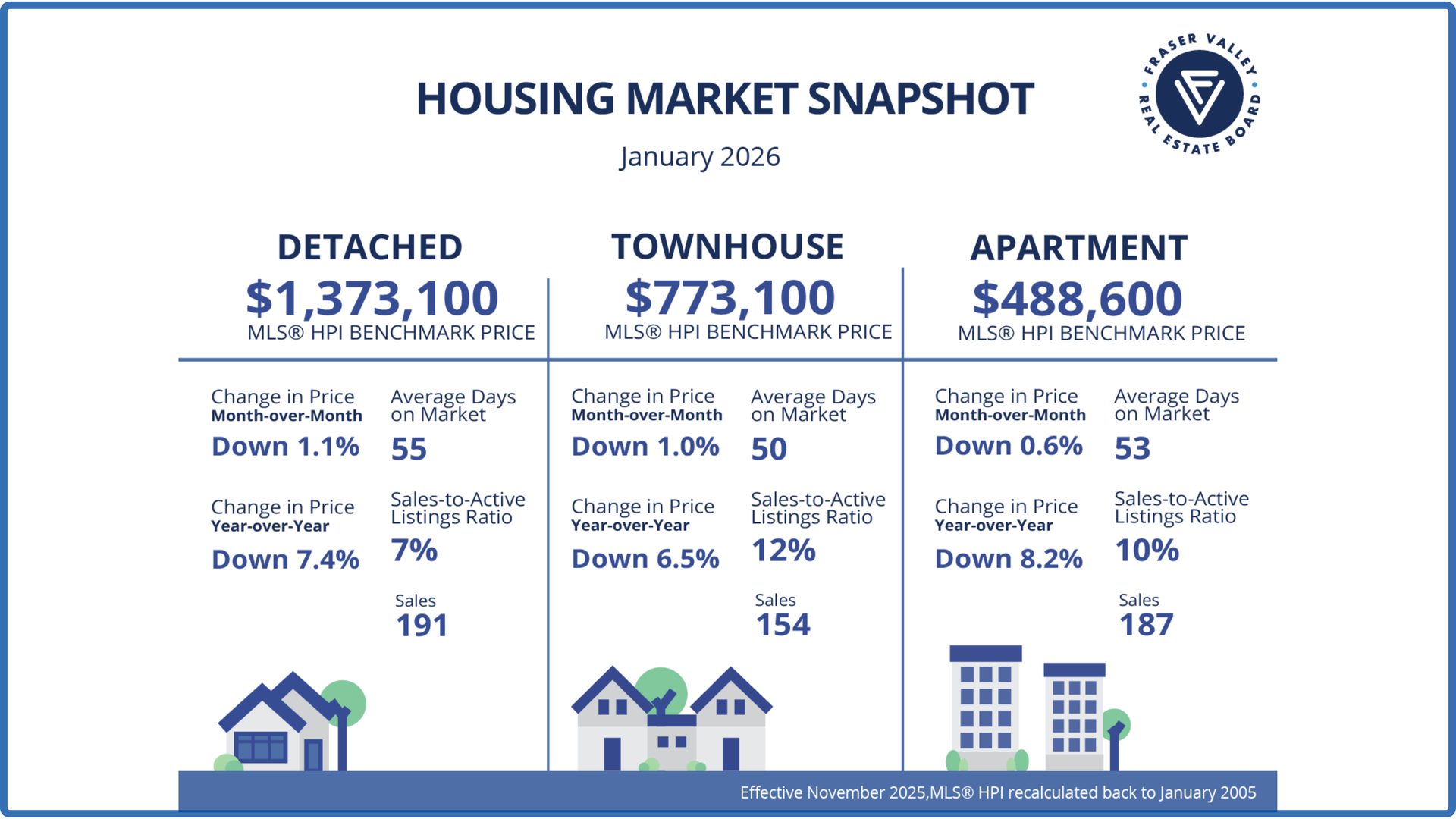

🏡 Fraser Valley home prices back to pandemic-era levels under the weight of economic headwinds and sustained inventory 📉 SURREY, BC – Home prices in the Fraser Valley fell for the tenth consecutive month in January, pushing the Benchmark price below $900,000 for the first time since spring 2021. The Benchmark price for a typical home in the Fraser Valley dropped one per cent in January to $897,200, down 6.9 per cent year-over-year. The continued softening of prices wasn’t enough to get buyers off the sidelines, as the Fraser Valley Real Estate Board recorded 619 sales on its Multiple Listing Service® (MLS®) in January, a 33 per cent decrease from December, and 24 per cent below sales from the same month last year. New listings increased 128 per cent in January to 3,078, reflecting the typical seasonal patterns; however, activity remained 10 per cent below last year’s levels.

⏸️ Fraser Valley Market Paused | 2026 Outlook Looking for straight talk about real estate in Langley and the Fraser Valley? In this playlist, Realtor Andy Schildhorn shares honest, experience-backed insights into the housing market, the buying and selling process, and what’s really going on behind the scenes. Whether it’s market conditions, policy changes, or personal stories that affect buyers and sellers alike, Andy Talks Real Estate & More brings a local, no-fluff perspective that helps you make smarter decisions—without the jargon. 🎙️ Real estate insights with 30 years of experience 📍 Focused on Langley, Fort Langley, and Fraser Valley communities 💬 Includes conversations, quick tips, personal experiences & more Ready to make your next move with clarity and confidence? 📅 Book a call: https://rly.forsale/Chat-with-Andy 📞 778-835-8957 🌐 www.AndytheRealtor.com