B.C. working to strengthen protection for home buyers

BC Gov News • November 12, 2021

To better protect consumers in B.C.’s real estate market, the Province is introducing legislation that requires cooling off periods for resale properties and newly built homes.

This change will be similar to the cooling off periods already in place for pre-construction condominium sales.

BC Financial Services Authority (BCFSA) is being asked to consult with key stakeholders and experts and review other potential consumer protection measures. This includes looking at the blind bidding system, as well as condition waiving in offers and other practices that may pose risks to consumers.

These issues are being investigated in the context of a period of continued robust real estate market activity, where concerns have been raised that buyers may be purchasing a home without everything they need to make fully informed decisions.

“People looking to buy a home need to know they are protected as they make one of the biggest financial decisions of their lives. Especially in periods of heightened activity in the housing market, it’s crucial that we have effective measures in place so that people have the peace of mind that they’ve made the right choices,” said Selina Robinson, Minister of Finance. “With this step, we’re moving ahead to protect people and their interests in the real estate market by bringing in a cooling off period for homebuyers and looking at additional measures to ensure effective safeguards are in place.”

Cooling off periods are limited periods of time in which buyers can change their minds and cancel the purchase with no or diminished legal consequences. BCFSA will consult with key industry stakeholders and experts to help determine the parameters of a cooling off period for resale properties and newly built homes and will present advice to government in early 2022. Enabling legislation for cooling off periods will be drafted and targeted for introduction in spring 2022.

“Ensuring fair markets and promoting public confidence in B.C.’s real estate market is a key priority of BCFSA, and we welcome the direction from the minister to lead this valuable consultation work,” said Blair Morrison, CEO of BCFSA and superintendent of real estate. “BCFSA’s goal is to ensure that British Columbians are protected when buying and selling homes – one of the most important financial transactions of their lives. Both buyers and sellers need to be supported and have time to make good financial decisions.”

On Aug. 1, 2021, BCFSA became the single regulator for all financial services in B.C., including real estate. The creation of a single authority responsible for regulating real estate in B.C. helps ensure a more co-ordinated approach to regulating all parts of the financial sector and better protects British Columbians buying and selling homes.

BCFSA will start its industry consultation in the coming weeks. Terms of reference can be found here: https://www.bcfsa.ca/

Quick Facts:

This change will be similar to the cooling off periods already in place for pre-construction condominium sales.

BC Financial Services Authority (BCFSA) is being asked to consult with key stakeholders and experts and review other potential consumer protection measures. This includes looking at the blind bidding system, as well as condition waiving in offers and other practices that may pose risks to consumers.

These issues are being investigated in the context of a period of continued robust real estate market activity, where concerns have been raised that buyers may be purchasing a home without everything they need to make fully informed decisions.

“People looking to buy a home need to know they are protected as they make one of the biggest financial decisions of their lives. Especially in periods of heightened activity in the housing market, it’s crucial that we have effective measures in place so that people have the peace of mind that they’ve made the right choices,” said Selina Robinson, Minister of Finance. “With this step, we’re moving ahead to protect people and their interests in the real estate market by bringing in a cooling off period for homebuyers and looking at additional measures to ensure effective safeguards are in place.”

Cooling off periods are limited periods of time in which buyers can change their minds and cancel the purchase with no or diminished legal consequences. BCFSA will consult with key industry stakeholders and experts to help determine the parameters of a cooling off period for resale properties and newly built homes and will present advice to government in early 2022. Enabling legislation for cooling off periods will be drafted and targeted for introduction in spring 2022.

“Ensuring fair markets and promoting public confidence in B.C.’s real estate market is a key priority of BCFSA, and we welcome the direction from the minister to lead this valuable consultation work,” said Blair Morrison, CEO of BCFSA and superintendent of real estate. “BCFSA’s goal is to ensure that British Columbians are protected when buying and selling homes – one of the most important financial transactions of their lives. Both buyers and sellers need to be supported and have time to make good financial decisions.”

On Aug. 1, 2021, BCFSA became the single regulator for all financial services in B.C., including real estate. The creation of a single authority responsible for regulating real estate in B.C. helps ensure a more co-ordinated approach to regulating all parts of the financial sector and better protects British Columbians buying and selling homes.

BCFSA will start its industry consultation in the coming weeks. Terms of reference can be found here: https://www.bcfsa.ca/

- In B.C., real estate markets have experienced significant volatility this year due to low interest rates, pent-up demand for additional living space following COVID-19 shutdowns and low inventory.

- In response to heightened market activity, BCFSA continues to provide consumer awareness information to educate consumers about the risks of a highly competitive market.

- Seven-day cooling off periods for pre-construction sales of multi-unit development properties, like condominiums, are currently in place under the Real Estate Development and Marketing Act.

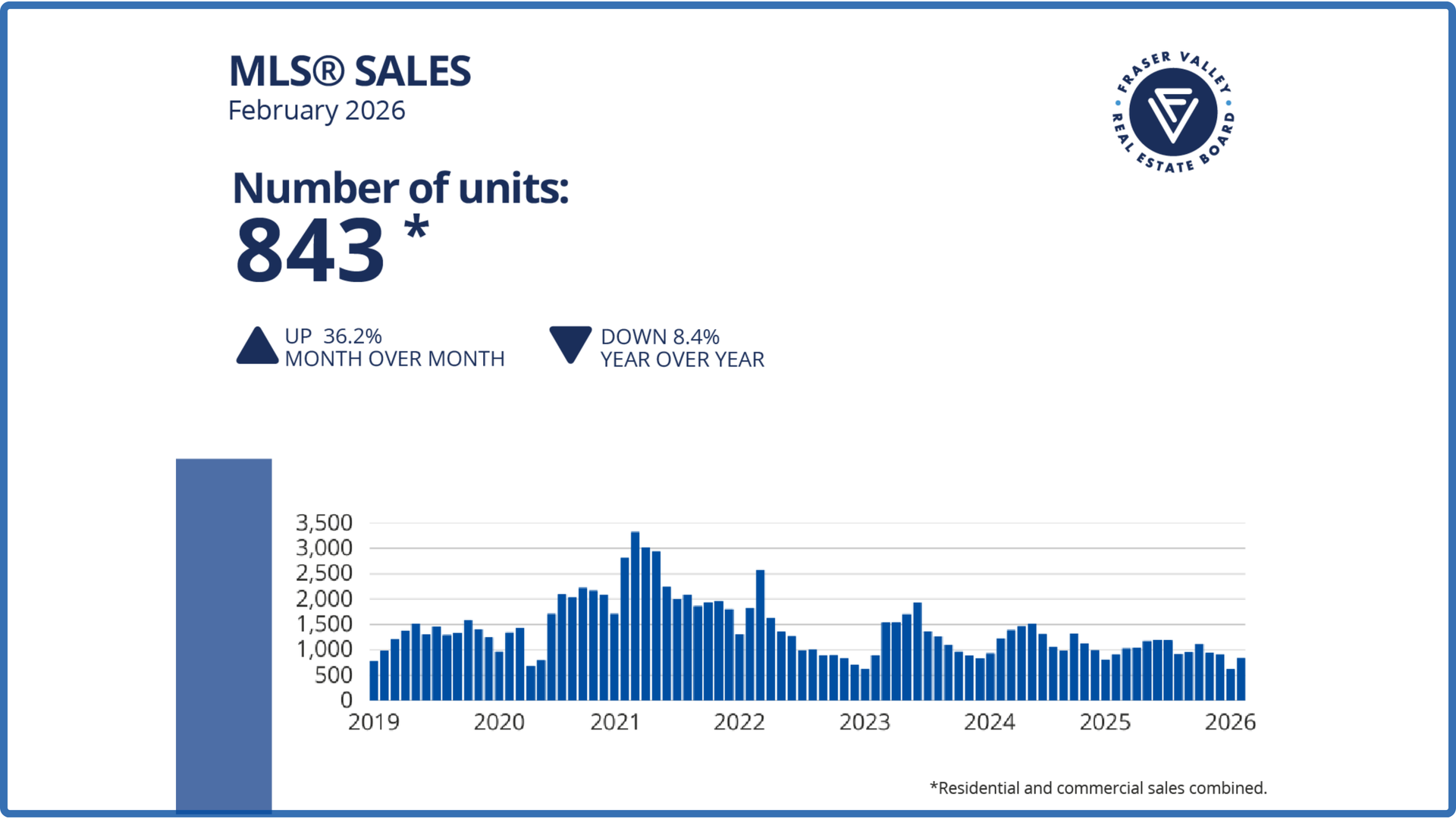

SURREY, BC – The Fraser Valley market showed early signs of a spring thaw in February, with sales increasing over January, but continuing to trail typical levels for this time of year. The Fraser Valley Real Estate Board recorded 843 sales on its Multiple Listing Service® (MLS®) in February, a 36 per cent increase from January, but 38 per cent below the ten-year seasonal average. New listings declined nine per cent in February to 2,796, suggesting some sellers are choosing to wait amid competitive inventory levels, and may be positioning their homes for the peak of the spring market.