Fraser Valley Housing Market Statistics July 2022

Sales slide for fourth straight month as rising interest rates put brakes on Fraser Valley real estate market

SURREY, BC – The Fraser Valley real estate market saw sales fall again in July in the face of continued interest rate hikes, as the government struggles to bring inflation under control.

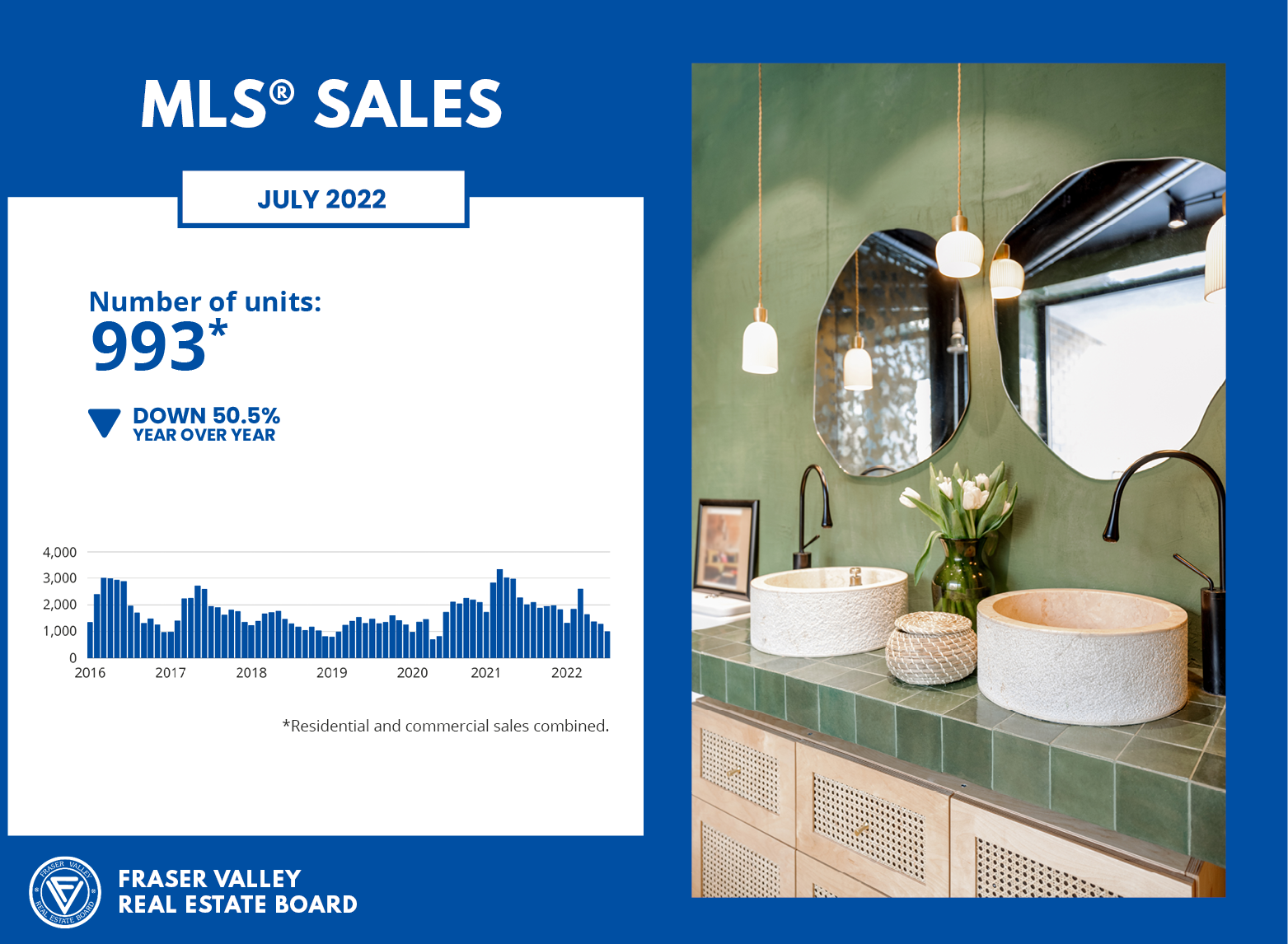

In July, the Fraser Valley Real Estate Board (FVREB) processed 993 sales on its Multiple Listing Service® (MLS®), a decrease of 22.5 per cent from the previous month and a 50.5 per cent drop compared to July 2021, when the province was still in acute pandemic mode. July new listings totaled 2,385, a 28.4 per cent decrease compared to June and a decrease of 1.9 per cent compared to July 2021.

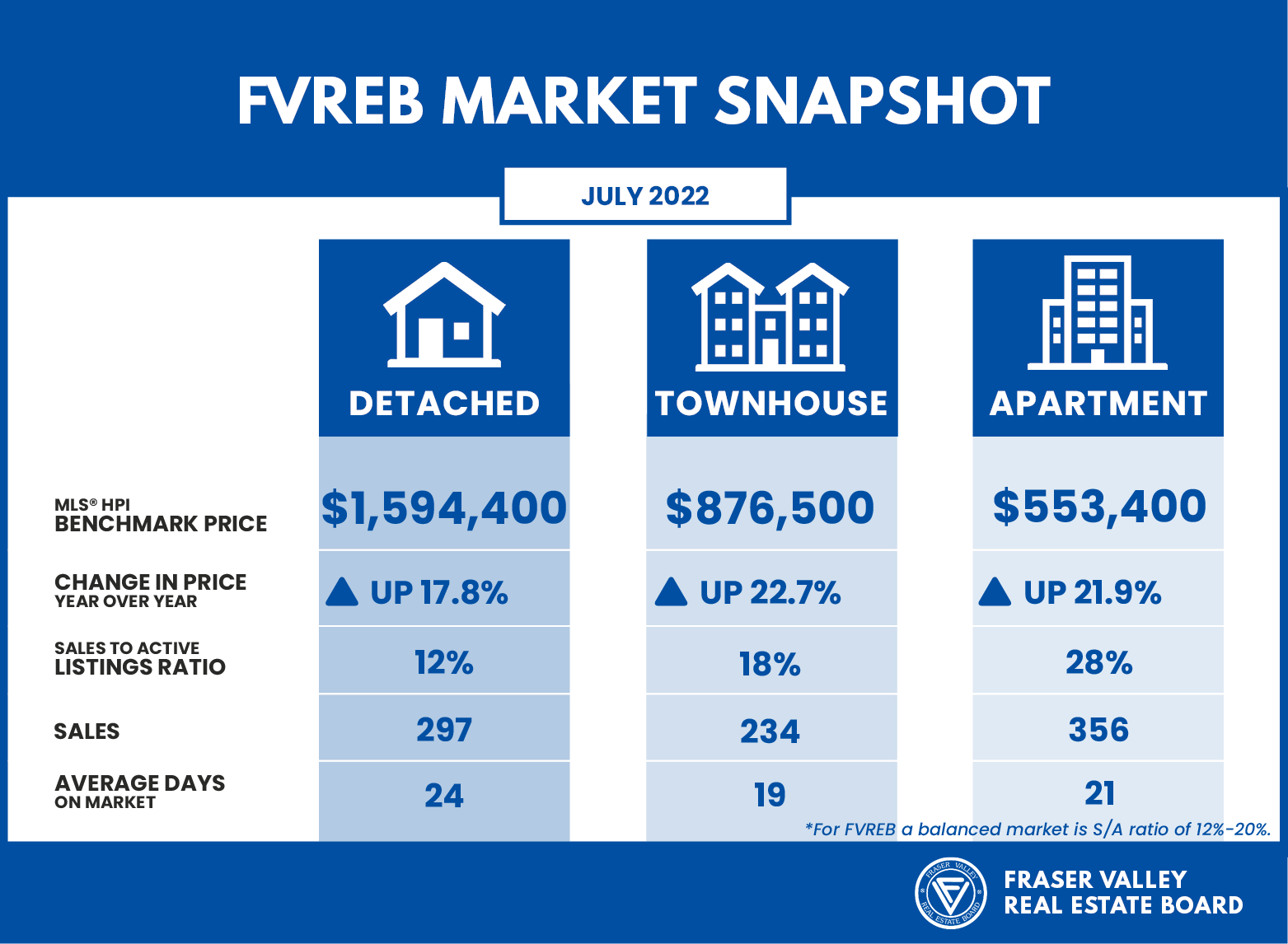

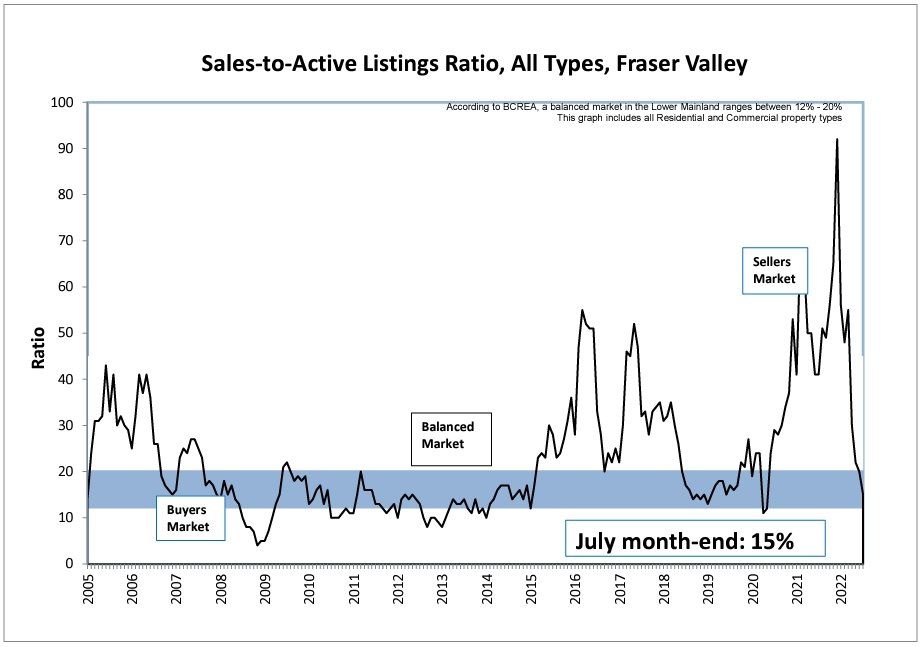

Active listings, at 6,413, remained relatively unchanged from June and were up 30.9 per cent over last July — bringing the sector into balance for townhomes and detached homes (sales-to-active ratios: 18 per cent and 12 per cent, respectively); and favouring sellers slightly for apartments (28 per cent). The market is considered balanced when the sales-to-active ratio is between 12 per cent and 20 per cent.

“It is important to keep in mind that real estate is and always will be an asset with considerable upside over the long-term,” said Fraser Valley Real Estate Board President, Sandra Benz. “As prices come down from the highs of recent months, there are opportunities for buyers who have been waiting to re-enter the market and shop for the right property."

Across the Fraser Valley in July, the average number of days to sell a single-family detached home was 24 and a townhome was 19 days. Apartments took, on average, 21 days to sell.

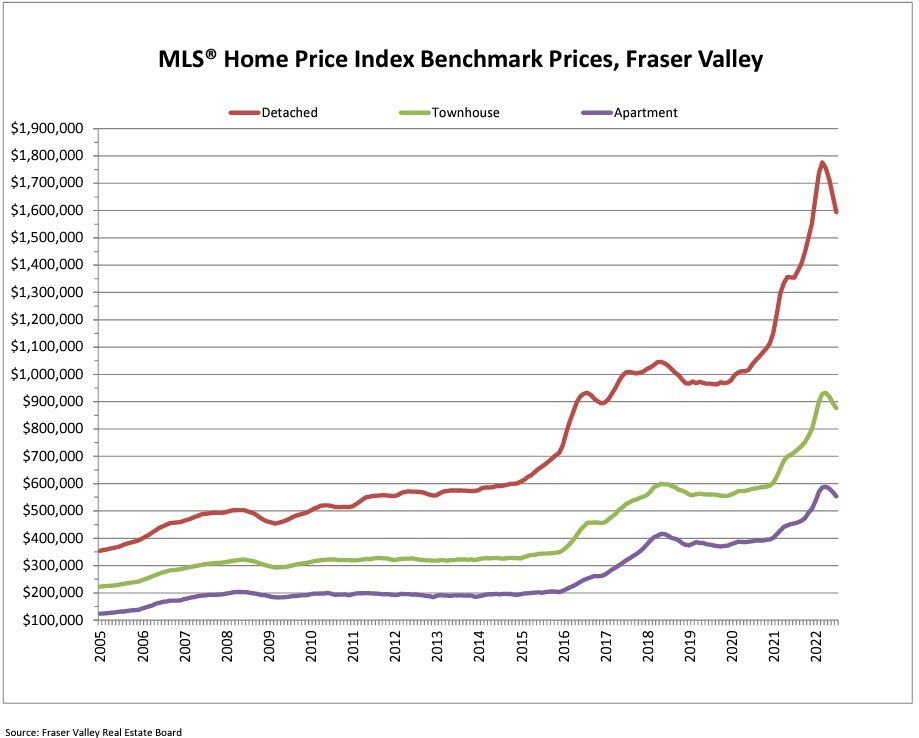

The weaker demand resulted in prices dropping for the fourth consecutive month, most notably for detached homes which ended the month with a benchmark price of $1,594,400, down 3.5 per cent from last month and by 10.2 per cent since peaking at $1,776,700 in March. Residential combined properties benchmark prices are still up year-over-year by 18.1 per cent.

“With rising interest rates and uncertainty in the market, it is even more important to seek out the guidance of a professional REALTOR®,” said Board CEO, Baldev Gill. “Their ability to tap into the latest data and market intelligence — down to the neighbourhood level — allows buyers and sellers to make informed decisions about one of the largest transactions they’ll ever make.”