Market Numbers July 06, 2022

Andy Schildhorn • July 6, 2022

Fraser Valley housing market continues to cool amid slower sales, softer price.

SURREY, BC

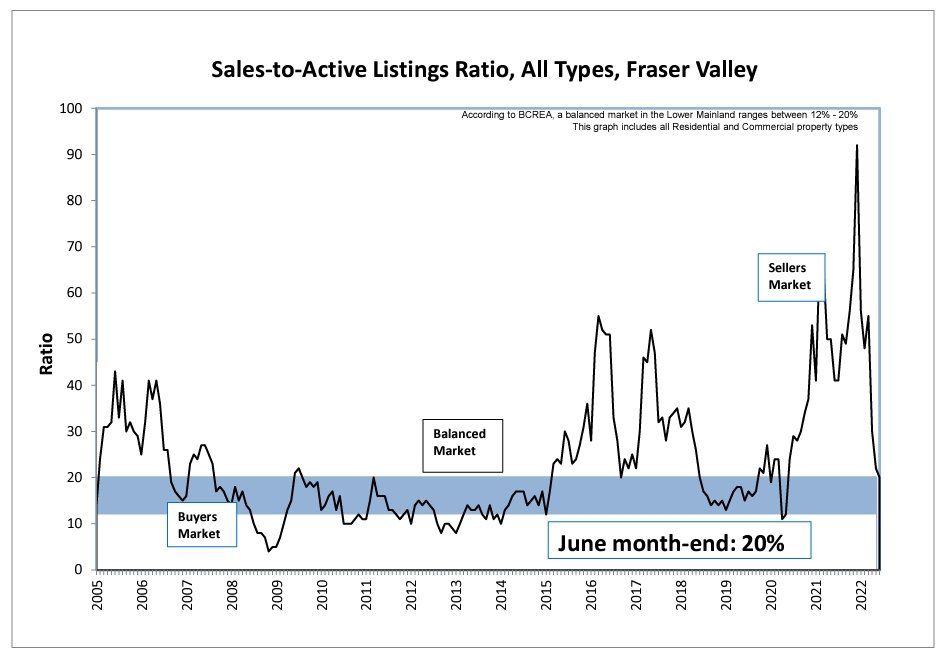

– Overall sales in the Fraser Valley fell for the third straight month as prices for all property types continued to soften, bringing greater balance to the region’s real estate market.

In June, the Board processed 1,281 sales on its Multiple Listing Service® (MLS®), a decrease of 5.8 per cent compared to May and a 43 per cent decrease compared to June of last year.

Sandra Benz, President of the Board, said, “In just two months our market overall has shifted into balance mainly due to a softening of demand for single-family detached homes.

“The condo and townhome markets, although they have moderated, they continue to favour sellers as the sales-to-active listings ratios continue to trend higher, however with fewer multiple offer situations compared to previous months, it’s likely that we will see further softening in these property types as we return to pre-COVID work-life routines.”

In June, the Board received 3,332 new listings, an increase of 7.2 per cent compared to last year, and a decrease of 8.2 per cent compared to last month. The month ended with a total active inventory of 6,474, a 4.7 per cent increase compared to May, and 18.3 per cent more than June 2021.

In June, the Board processed 1,281 sales on its Multiple Listing Service® (MLS®), a decrease of 5.8 per cent compared to May and a 43 per cent decrease compared to June of last year.

Sandra Benz, President of the Board, said, “In just two months our market overall has shifted into balance mainly due to a softening of demand for single-family detached homes.

“The condo and townhome markets, although they have moderated, they continue to favour sellers as the sales-to-active listings ratios continue to trend higher, however with fewer multiple offer situations compared to previous months, it’s likely that we will see further softening in these property types as we return to pre-COVID work-life routines.”

In June, the Board received 3,332 new listings, an increase of 7.2 per cent compared to last year, and a decrease of 8.2 per cent compared to last month. The month ended with a total active inventory of 6,474, a 4.7 per cent increase compared to May, and 18.3 per cent more than June 2021.

Baldev Gill, Chief Executive Officer of the Board, added, “With five-year fixed rates at their highest levels in a decade and residential prices, though softening month-over-month, are still more than 20 per cent higher than a year ago, we expect to see sales continue to decline over the near term.

“The combination of higher rates and low inventory will present a barrier to first-time buyers and could result in even slower sales over the coming months and erase price gains from the past 10 months or so.”

Across Fraser Valley, in June, the average number of days to sell a single-family detached home was 21 and a townhome was 19 days. Apartments took, on average, 17 days to sell.

Across Fraser Valley, in June, the average number of days to sell a single-family detached home was 21 and a townhome was 19 days. Apartments took, on average, 17 days to sell.

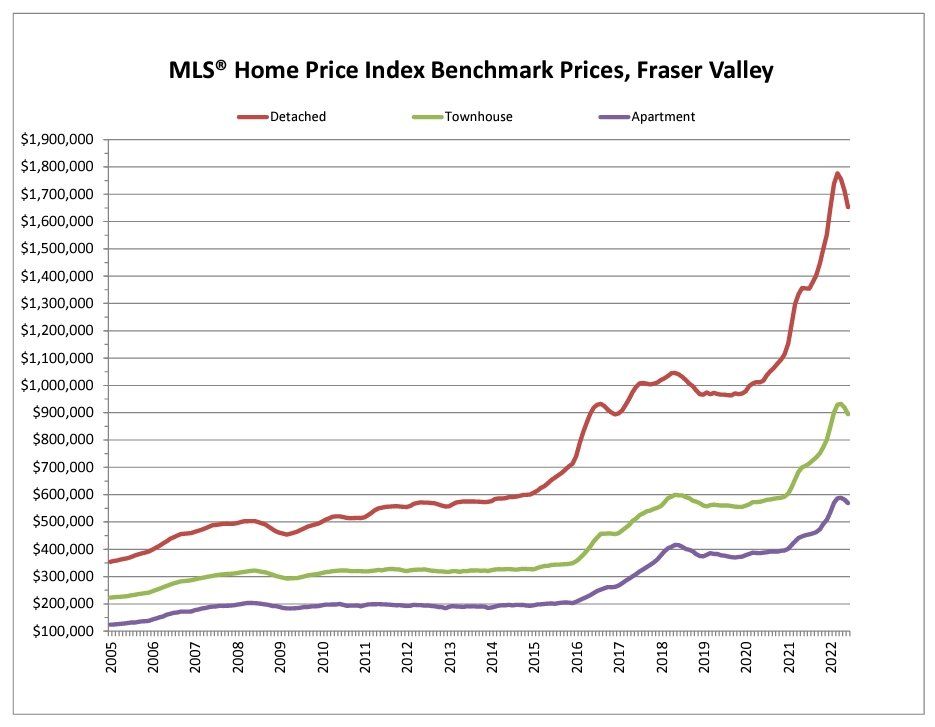

MLS® HPI Benchmark Price Activity

- Single Family Detached: At $1,653,000, the Benchmark price for an FVREB single-family detached home decreased 3.5 per cent compared to May 2022 and increased 21.9 per cent compared to June 2021.

- Townhomes: At $894,300, the Benchmark price for an FVREB townhome decreased 2.7 per cent compared to May 2022 and increased 26.6 per cent compared to June 2021.

- Apartments: At $568,700, the Benchmark price for an FVREB apartment/condo decreased 2.2 per cent compared to May 2022 and increased 25.9 per cent compared to June 2021.