What You Need to Know Before You Buy

Rita & Rachel Cousins Mortgage Planners • March 9, 2020

Spring is one of the busiest seasons for retail activity as the good weather gives people lots of time for decluttering, showing the home, garage sales, packing and moving into your new space! Buying a home is an extremely exciting and fulfilling adventure, but before you get started let’s go through some of the most important things you need to know before you buy a home.

First things first, are you ready to own a home? This is likely the largest financial decision you will ever make and there are a few questions you can ask yourself to ensure you are ready:

- Are you financially stable?

- Do you have the financial management skills and discipline to handle a purchase of this magnitude?

- Are you ready to devote the time to regular home maintenance?

- Are you aware of all the costs and responsibilities that come with being a homeowner?

If you answered ‘yes’ to the above questions, congrats! You’re on the right track. Let’s look at some of the most important things to know:

Securing Your Down Payment

A down payment is the largest, upfront cost that comes with purchasing a home. The minimum on any mortgage in Canada is 5 percent but putting down more whenever possible will lower the amount being borrowed.

Note * If you are putting down less than 20 percent, default insurance will be mandatory to protect the investment.

If you have a nest egg of savings that you can apply towards the down payment, then you are ready to move on! If not, RRSPs can be a great resource towards a down payment for a first-time home buyer (up to $35,000). Another option is a gift from a family member, which requires a Gift Letter stating that the money does not have to be repaid and a snapshot showing that the gifted funds have been transferred.

If these are not options for you, then you can still work on ensuring you have a good credit score and determining your budget while saving for a down payment in the meantime.

Getting Your Credit in Order

Ensuring your finances and credit is in order will make it easier to qualify for a mortgage and can be done while you’re saving for your down payment. Ensuring good credit simply involves paying your bills on time (rent, utilities, car payments) and ensuring your credit cards are paid monthly as well as keeping the balance below 75 per cent of the available limit. If you’re new to the world of credit, consider the 2-2-2 rule. Lenders want to see two forms of resolving credit (ie: credit cards) with limits no less than $2,000 and a clean payment history for two years. Another important note is to avoid making any credit mistakes or other major purchases (such as a new car) until after you have mortgage approval and have closed the deal on your new home.

Don’t Use Your Maximum Budget

Temptation will always be to start looking at the very top of your budget, but it is important to remember that there will be fees, such as mandatory closing costs, which can range from 1 to 4% of the purchase price. Factoring these into your maximum budget can help you narrow down a home that is entirely affordable and ensure future financial stability and security.

Get Pre-Approved

A mortgage pre-approval determines the actual home price you can afford and is different from the pre-qualification in that it requires submission and verification of your financial history. A pre-approval can determine the maximum you can afford to spend, the monthly mortgage payment associated with your purchase price range and the mortgage rate for your first term. Getting pre-approved also guarantees the rate offered to you will be locked in from 90 to 120 days which helps if interest rates rise while you are still shopping.

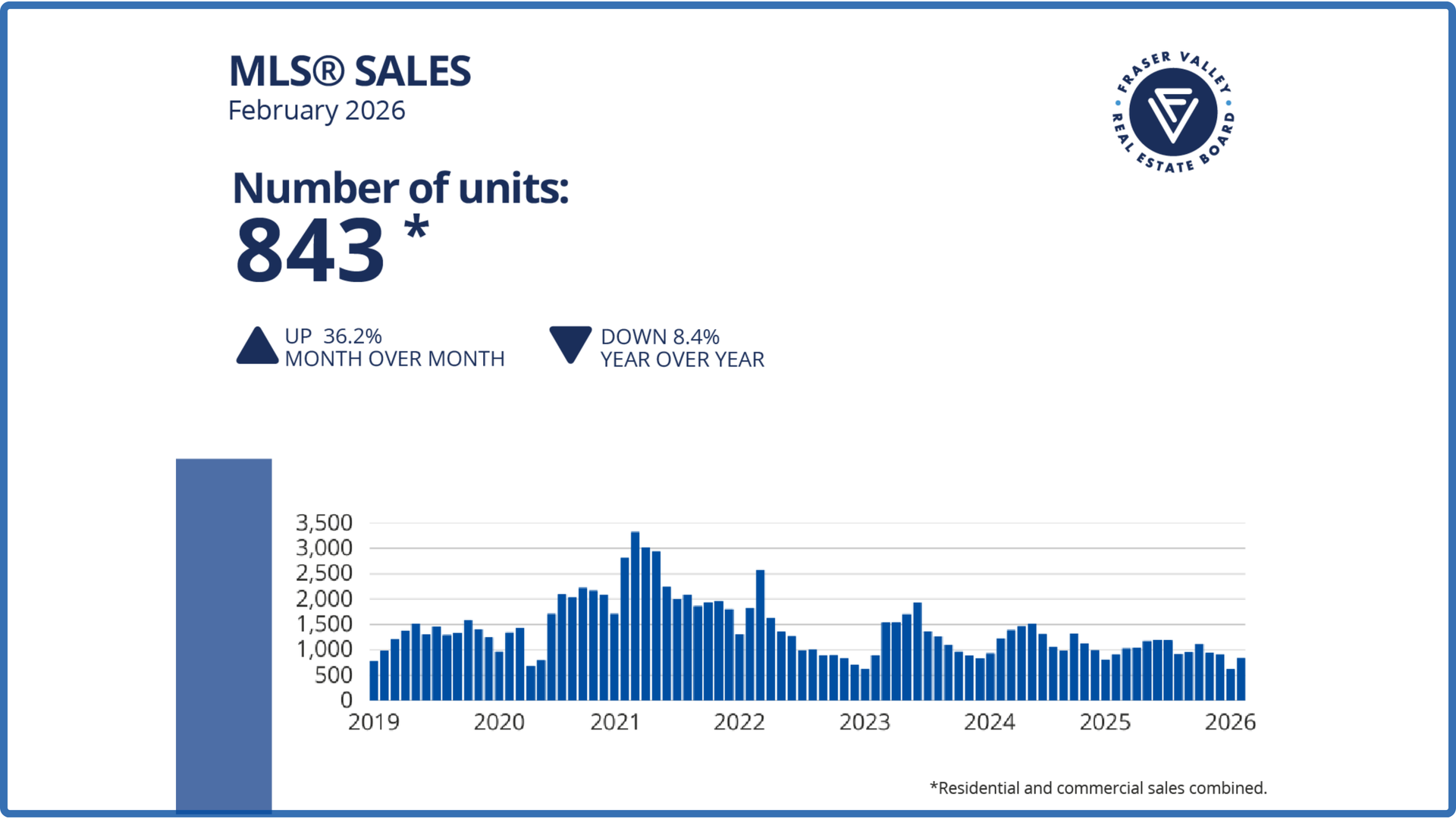

SURREY, BC – The Fraser Valley market showed early signs of a spring thaw in February, with sales increasing over January, but continuing to trail typical levels for this time of year. The Fraser Valley Real Estate Board recorded 843 sales on its Multiple Listing Service® (MLS®) in February, a 36 per cent increase from January, but 38 per cent below the ten-year seasonal average. New listings declined nine per cent in February to 2,796, suggesting some sellers are choosing to wait amid competitive inventory levels, and may be positioning their homes for the peak of the spring market.