New B.C. land ownership transparency registry needs time to test its effectiveness: Advocate

Gordon Hoekstra - Vancouver Sun • June 15, 2021

The first-of-its-kind registry, one of the B.C. government's actions to combat money laundering in real estate, opened to public April 30.

When you search B.C.’s first-of-its-kind land transparency registry some beneficial ownership information will be blocked because the new law that underpins the registry requires a 90-day holding period before the info is publicly released.

Cohen noted that one shortfall is there is no jail time for falsifying or not properly filing information, only penalties up to $25,000 for individuals and $50,000 for companies. He said it’s hardly a deterrent given the high stakes of money laundering.

Recently, the C.D. Howe Institute, a Toronto-based think-tank, criticized the registry for not having proactive verification of identification information for beneficial owners, which it said renders the info of little value to law-enforcement agencies and other searchers. The institute also noted that the registry didn’t have a confidential tip line through which searchers from around the world could send key information and evidence to Canadian law-enforcement agencies and the Canada Revenue Agency.

In a report, C.D. Howe author Kevin Comeau said the registry will likely do little to stop money laundering in B.C. real estate.

However, the push to create more transparent, publicly accessible information on corporate and property ownership to thwart money laundering and other activities, such as tax evasion, is gaining momentum. The U.K. is meant to introduce a property ownership transparency registry but it’s not clear when that will happen.

The U.K. already put in place a public beneficial corporate ownership registry in 2016 called the People with Significant Control Register that can be searched through the country’s Companies House website. The basic search that provides information on a company’s directors and beneficial owners is free. It was searched more than two billion times in 2017, according to a British House of Commons report.

When you search B.C.’s first-of-its-kind land transparency registry some beneficial ownership information will be blocked because the new law that underpins the registry requires a 90-day holding period before the info is publicly released.

The registry, one of the B.C. government’s actions to combat money laundering in real estate, opened to the public April 30.

And because companies, trusts and limited partnerships weren’t required to begin filing transparency reports until the end of November, there is only 2 1/2 months of filings that are accessible, those from Nov. 30 to mid-February, 2021.

Postmedia News searched 10 random trusts, limited partnership and corporations, including numbered companies, but none revealed the beneficial owners because all were blocked for now under the 90-day rule.

It underscores that the power of the registry — also given that beneficial owners that bought property before Nov. 30, 2020, have another six months to file transparency reports — will take some time to reach full strength.

Advertisement

There has also been some criticism of the registry including that it’s not free to search, the identities of beneficial owners aren’t verified, sanctions for false filings don’t carry prison sentences and it’s not likely to capture individual nominee owners who hold properties for beneficial owners.

However, property and corporate ownership transparency advocates say some time should be given to see how the registry works and whether it will need improvements.

“It’s still a big step forward. Let’s give it a chance … have some people test and scrutinize it,” says James Cohen, executive director of Transparency International Canada, a global anticorruption advocacy group. “This is why it’s important for it to be publicly accessible for external bodies to assess it and give unfettered feedback about how it works.”

The registry is accessed through the Land Title and Survey Authority of B.C.’s web portal, for which you need an account to access documents. There is a link to the registry on the land title portal.

It costs $5 to search an individual’s name, a corporation or a nine-digit PID (permanent parcel identifier) that’s connected to each parcel of property in B.C. If you search a corporation, it will not provide the beneficial ownership information but will provide a PID associated with the company. You need to search the PID to obtain the beneficial ownership information.

As a result, starting with the company name, will cost you $10.

Postmedia News searched 10 random trusts, limited partnership and corporations, including numbered companies, but none revealed the beneficial owners because all were blocked for now under the 90-day rule.

It underscores that the power of the registry — also given that beneficial owners that bought property before Nov. 30, 2020, have another six months to file transparency reports — will take some time to reach full strength.

Advertisement

There has also been some criticism of the registry including that it’s not free to search, the identities of beneficial owners aren’t verified, sanctions for false filings don’t carry prison sentences and it’s not likely to capture individual nominee owners who hold properties for beneficial owners.

However, property and corporate ownership transparency advocates say some time should be given to see how the registry works and whether it will need improvements.

“It’s still a big step forward. Let’s give it a chance … have some people test and scrutinize it,” says James Cohen, executive director of Transparency International Canada, a global anticorruption advocacy group. “This is why it’s important for it to be publicly accessible for external bodies to assess it and give unfettered feedback about how it works.”

The registry is accessed through the Land Title and Survey Authority of B.C.’s web portal, for which you need an account to access documents. There is a link to the registry on the land title portal.

It costs $5 to search an individual’s name, a corporation or a nine-digit PID (permanent parcel identifier) that’s connected to each parcel of property in B.C. If you search a corporation, it will not provide the beneficial ownership information but will provide a PID associated with the company. You need to search the PID to obtain the beneficial ownership information.

As a result, starting with the company name, will cost you $10.

Cohen noted that one shortfall is there is no jail time for falsifying or not properly filing information, only penalties up to $25,000 for individuals and $50,000 for companies. He said it’s hardly a deterrent given the high stakes of money laundering.

Recently, the C.D. Howe Institute, a Toronto-based think-tank, criticized the registry for not having proactive verification of identification information for beneficial owners, which it said renders the info of little value to law-enforcement agencies and other searchers. The institute also noted that the registry didn’t have a confidential tip line through which searchers from around the world could send key information and evidence to Canadian law-enforcement agencies and the Canada Revenue Agency.

In a report, C.D. Howe author Kevin Comeau said the registry will likely do little to stop money laundering in B.C. real estate.

However, the push to create more transparent, publicly accessible information on corporate and property ownership to thwart money laundering and other activities, such as tax evasion, is gaining momentum. The U.K. is meant to introduce a property ownership transparency registry but it’s not clear when that will happen.

The U.K. already put in place a public beneficial corporate ownership registry in 2016 called the People with Significant Control Register that can be searched through the country’s Companies House website. The basic search that provides information on a company’s directors and beneficial owners is free. It was searched more than two billion times in 2017, according to a British House of Commons report.

The owner’s must have a 25 per cent stake to be named, whereas in B.C., in the land ownership transparency registry, it’s 10 per cent.

The U.K. and its overseas territories, including tax havens such as the British Virgin Islands, have also committed to extend public corporate transparency registries by as early as 2023. The European Union also has such a commitment, with France recently making its corporate registry public.

The U.S. has also passed legislation to create a corporate transparency registry that identifies beneficial owners, but it will not be open to the public, only to police and regulatory authorities.

B.C. also requires companies to file beneficial ownership information but it also remains accessible only to police and regulatory authorities for now.

In the federal budget released in April, Prime Minister Justin Trudeau’s government has promised $2.1 million to introduce a public federal corporate transparency registry by 2025. The federal registry, however, would only contain a fraction of companies in Canada and would need all provinces to come on-board to make it affective, according to advocacy groups such as Transparency International Canada.

A B.C. government panel report on money laundering and real estate, delivered in 2019, concluded that disclosure of beneficial ownership is the single most important measure that can be taken to combat money laundering but is “regrettably” underused both internationally and in Canada.

The U.K. and its overseas territories, including tax havens such as the British Virgin Islands, have also committed to extend public corporate transparency registries by as early as 2023. The European Union also has such a commitment, with France recently making its corporate registry public.

The U.S. has also passed legislation to create a corporate transparency registry that identifies beneficial owners, but it will not be open to the public, only to police and regulatory authorities.

B.C. also requires companies to file beneficial ownership information but it also remains accessible only to police and regulatory authorities for now.

In the federal budget released in April, Prime Minister Justin Trudeau’s government has promised $2.1 million to introduce a public federal corporate transparency registry by 2025. The federal registry, however, would only contain a fraction of companies in Canada and would need all provinces to come on-board to make it affective, according to advocacy groups such as Transparency International Canada.

A B.C. government panel report on money laundering and real estate, delivered in 2019, concluded that disclosure of beneficial ownership is the single most important measure that can be taken to combat money laundering but is “regrettably” underused both internationally and in Canada.

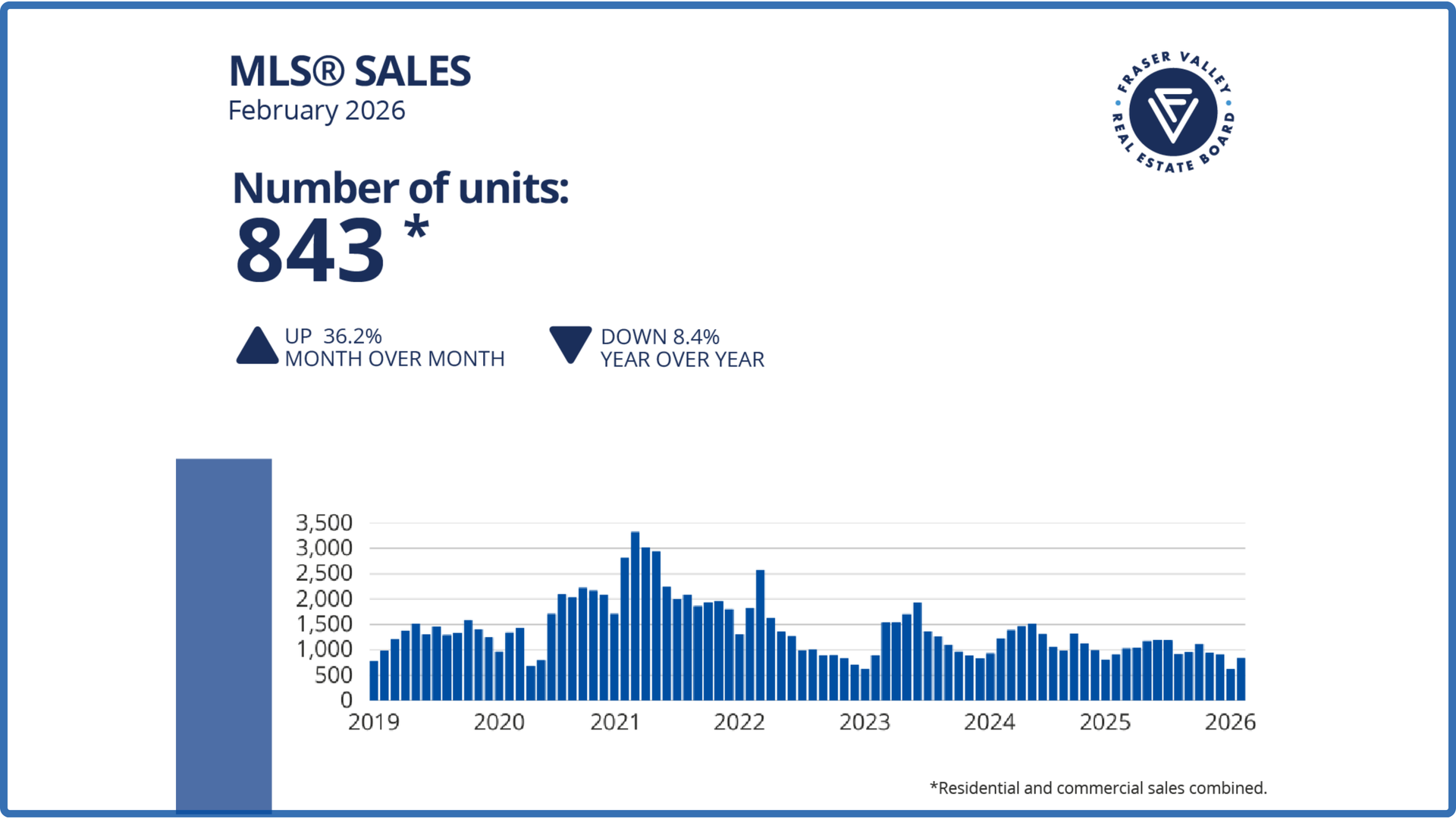

SURREY, BC – The Fraser Valley market showed early signs of a spring thaw in February, with sales increasing over January, but continuing to trail typical levels for this time of year. The Fraser Valley Real Estate Board recorded 843 sales on its Multiple Listing Service® (MLS®) in February, a 36 per cent increase from January, but 38 per cent below the ten-year seasonal average. New listings declined nine per cent in February to 2,796, suggesting some sellers are choosing to wait amid competitive inventory levels, and may be positioning their homes for the peak of the spring market.